Bank of Russia keeps the key rate at 21.00% p.a.

December 20, 2024

On 20 December 2024, the Bank of Russia Board of Directors decided to keep the key rate at 21.00% per annum. Monetary conditions tightened more significantly than envisaged by the October key rate decision. This is the result of the effects of factors autonomous from monetary policy.

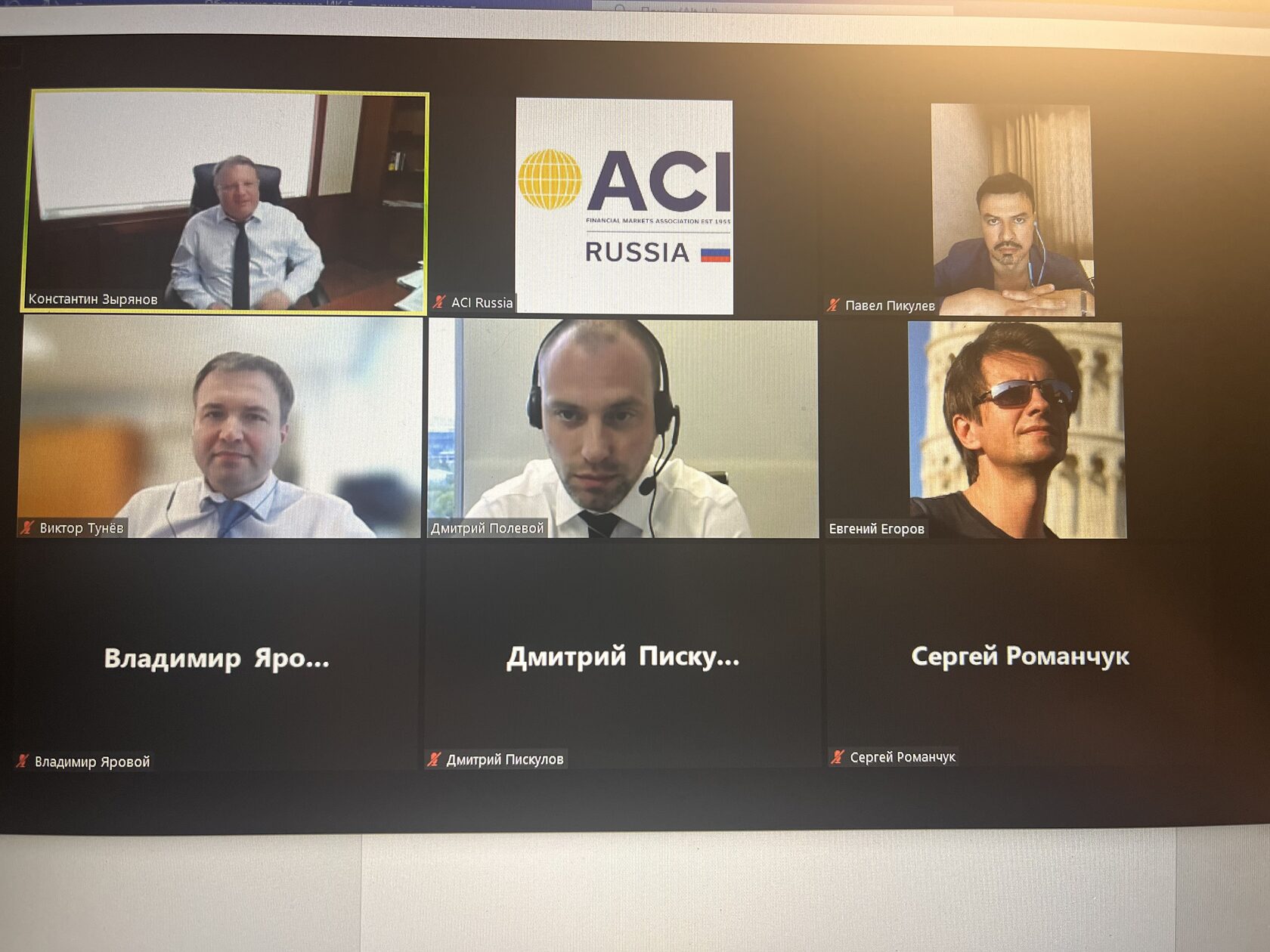

ACI Russia key Rate forecast

December 19, 2024

Expectations are concentrated around the decision to raise the key rate to 23%. At the same time, a visible part of the audience would support maintaining the current rate and even starting to lower it if they were in the place of the Bank of Russia representatives.

EFX & DIGITAL SUMMIT 2024 + New Year Party 2025

December 05, 2024

On December 2, 2024, The Sixth Annual Conference on the development of electronic commerce in the currency, money and digital markets - ACI Russia eFX & Digital Summit 2024, was held at Yakimanka Yarovit Hall (Moscow). And at the end, ACI Russia held its traditional New Year's Eve party, starting a series of New Year's corporate events in the financial markets.

On oil and gas revenues and foreign currency and gold purchase/sale transactions on the domestic currency market

December 04, 2024

The expected volume of additional oil and gas revenues for the federal budget is projected to be 95.9 billion rubles in December 2024.

The total deviation of the actual oil and gas revenues from the expected monthly volume of oil and gas revenues and the assessment of the base monthly volume of oil and gas revenues from the base monthly volume of oil and gas revenues in November 2024 was 18.5 billion rubles.

The total deviation of the actual oil and gas revenues from the expected monthly volume of oil and gas revenues and the assessment of the base monthly volume of oil and gas revenues from the base monthly volume of oil and gas revenues in November 2024 was 18.5 billion rubles.

Bank of Russia’s comment on fiscal rule-based operations in FX market

November 24, 2024

The Bank of Russia has decided that, from 28 November through 31 December 2024, it will not buy foreign currency in the domestic FX market to mirror regular fiscal rule-based operations conducted by the Ministry of Finance of the Russian Federation. This decision is aimed at reducing volatility in financial markets.

Moscow Exchange trading schedule for 2025 holidays

November 21, 2024

Moscow Exchange announces the trading schedule of its markets for the 2025 public holidays.

On 3, 6 and 8 January, 2 and 8 May, 13 June and 3 November 2025, which are the official non-business days in Russia, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On these days, all instruments will trade on the FX and Precious Metals Markets, except for trades with "today" settlement and swap transactions with their first parts settled on the trade date.

On the official public holidays of 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June, 4 November and December 31 2025, all Moscow Exchange markets will be closed.

Please note that 1 November is a working Saturday and trading will take place as normal.

On all other days in 2025, the markets will operate as usual.

On 3, 6 and 8 January, 2 and 8 May, 13 June and 3 November 2025, which are the official non-business days in Russia, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On these days, all instruments will trade on the FX and Precious Metals Markets, except for trades with "today" settlement and swap transactions with their first parts settled on the trade date.

On the official public holidays of 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June, 4 November and December 31 2025, all Moscow Exchange markets will be closed.

Please note that 1 November is a working Saturday and trading will take place as normal.

On all other days in 2025, the markets will operate as usual.

ACI Russia eFX & Digital Summit 2024

November 13, 2024

In the first days of winter, Moscow will host a key event for the development of electronic commerce in the foreign exchange, money and digital markets - ACI Russia eFX & Digital Summit 2024

Date: Monday, December 2, 2024

Time: from 9:30 a.m. to Tuesday

Location: Yakimanka Yarovit Hall. Parking is not provided

Event website acirussia.org/efxsummit

Telegram channel of the event t.me/efxsummit

Date: Monday, December 2, 2024

Time: from 9:30 a.m. to Tuesday

Location: Yakimanka Yarovit Hall. Parking is not provided

Event website acirussia.org/efxsummit

Telegram channel of the event t.me/efxsummit

Innovations in the foreign exchange market since November 11

November 1, 2024

In the foreign exchange market, in order to stabilize the exchange rate in case of sharp price movements during trading, which led to the need to shift the current boundaries after the expiration of the set waiting time for the market, a Price Adjustment Auction is introduced on the bar.

The start of the Price Adjustment Auction is announced immediately after the automatic border shift, along with a message about the border shift. The Price Adjustment Auction is launched for all spot instruments of the currency pair for which the boundaries have shifted.

During the Price Adjustment Auction, bids submitted using the TWAP algorithm are not accepted by the Trading System. The unrealized volumes in such applications will be distributed to subsequent iterations from this package according to the standard procedure.

The start of the Price Adjustment Auction is announced immediately after the automatic border shift, along with a message about the border shift. The Price Adjustment Auction is launched for all spot instruments of the currency pair for which the boundaries have shifted.

During the Price Adjustment Auction, bids submitted using the TWAP algorithm are not accepted by the Trading System. The unrealized volumes in such applications will be distributed to subsequent iterations from this package according to the standard procedure.

Monetary Policy Guidelines for 2025–2027

October 30, 2024

In the Monetary Policy Guidelines, the Bank of Russia each year describes the goals of monetary policy and approaches to its implementation and presents its view of the current situation in the economy and forecasts of its development in the medium term.

Bank of Russia increases the key rate by 200 bp to 21.00% p.a.

October 25, 2024

On 25 October 2024, the Bank of Russia Board of Directors decided to increase the key rate by 200 basis points to 21.00% per annum. Inflation is running considerably above the Bank of Russia’s July forecast. Inflation expectations continue to increase.

ACI Russia Key Rate survey

October 25, 2024

There is not even close to a consensus. The discussion about the current policy on the part of the Bank of Russia is gaining momentum. This is reflected in the dispersion of opinions, especially regarding how the respondent would vote if he were a member of the Council.

Moscow Exchange trading schedule for 2025 holidays

October 24, 2024

Moscow Exchange announces the trading schedule of its markets for the 2025 public holidays.

On 3, 6 and 8 January, 2 and 8 May, 13 June and 3 November 2025, which are the official non-business days in Russia, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On these days, all instruments will trade on the FX and Precious Metals Markets, except for trades with "today" settlement and swap transactions with their first parts settled on the trade date.

On the official public holidays of 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June, 4 November and December 31 2025, all Moscow Exchange markets will be closed.

Please note that 1 November is a working Saturday and trading will take place as normal.

On all other days in 2025, the markets will operate as usual.

On 3, 6 and 8 January, 2 and 8 May, 13 June and 3 November 2025, which are the official non-business days in Russia, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On these days, all instruments will trade on the FX and Precious Metals Markets, except for trades with "today" settlement and swap transactions with their first parts settled on the trade date.

On the official public holidays of 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June, 4 November and December 31 2025, all Moscow Exchange markets will be closed.

Please note that 1 November is a working Saturday and trading will take place as normal.

On all other days in 2025, the markets will operate as usual.

EFX & DIGITAL SUMMIT 2024 + NEW YEAR PARTY

October 22, 2024

We are pleased to announce that we are opening registration for the key event for the development of electronic commerce in the currency, financial and digital markets in 2024 — ACI Russia eFX & Digital Summit 2024!

On December 2, the Yakimanka Yarovit Hall conference on electronic trading in the currency, financial and digital markets will bring together participants of the financial industry for the 6th time to openly discuss current issues and trends affecting the development of instruments, infrastructure and technologies in the markets of currency, derivatives and digital instruments, establishing relationships and entering into partnerships.

Well, after the official part, we are waiting for all our guests, friends and partners at the New Year's Eve party (do not forget to check the box in the registration form!) Start celebrating the New Year with ACI Russia.

On December 2, the Yakimanka Yarovit Hall conference on electronic trading in the currency, financial and digital markets will bring together participants of the financial industry for the 6th time to openly discuss current issues and trends affecting the development of instruments, infrastructure and technologies in the markets of currency, derivatives and digital instruments, establishing relationships and entering into partnerships.

Well, after the official part, we are waiting for all our guests, friends and partners at the New Year's Eve party (do not forget to check the box in the registration form!) Start celebrating the New Year with ACI Russia.

The government has relaxed the conditions for the mandatory sale of foreign exchange earnings by exporters

October 11, 2025

The general requirement for the sale of 90% of the repatriated proceeds remains, but the norm is changing, according to which at least 50% of the funds received under each export contract must be realized within no more than 30 days from the date of their receipt. Now this bar has been lowered to 25%.

Registration for the exam, an analogue of the international CFA for financiers, has started

September 17, 2024

In Russia, registration for the National Financial Analyst Certificate (SFA) exam opens on September 17. The pilot exam will be held on December 14th. This is an analogue of the international CFA (Chartered Financial Analyst certification, conducted by the CFA Institute). The organization has not been testing in Russia since the spring of 2022.

Bank of Russia presents financial market development programme through 2027

September 16, 2024

The priority areas of the financial market development for the next three years include enhancing the role of the capital market as a source of business financing, improving long-term saving and investment tools for individuals, boosting confidence in the market and strengthening the protection of investors' rights.

Bank of Russia increases the key rate by 100 bp to 19.00% p.a.

September 13, 2024

On 13 September 2024, the Bank of Russia Board of Directors decided to increase the key rate by 100 basis points to 19.00% per annum. Current inflationary pressures remain high. By the end of 2024, annual inflation is likely to exceed the July forecast range of 6.5–7.0%.

The traditional survey on the key rate before the decision of the Bank of Russia

September 12, 2024

Most predict that the rate will remain at the current level. About a third of the community believes that the rate can be raised up to 200 bps. No one believes in its reduction, but part of the community in the place of the Central Bank would start this process at the next meeting. Not only the decision will be important, but also the rhetoric after it.

Bank of Russia extends restrictions on foreign cash withdrawals for another six months until 9 March 2025

September 5, 2024

The Bank of Russia preserves the foreign cash restrictions due to the sanctions enacted against Russia, which prohibit domestic financial institutions from purchasing western countries’ cash

Monetary Policy Guidelines for 2025–2027

August 29, 2024

In the Monetary Policy Guidelines, the Bank of Russia each year describes the goals of monetary policy and approaches to its implementation and presents its view of the current situation in the economy and forecasts of its development in the medium term.

DEALER'S FEST 2024

August 07, 2024

It was on this date that a new era of the Russian financial market began. Those who "survived" received a harsh lesson in proper risk management, the importance of trust and the need for proper development of public finances. Over the years, we continue to learn, look for non-standard solutions and steadfastly accept the challenges that reality poses to us.

ACI Russia is pleased to invite all our friends and partners to spend this significant day with us

ACI Russia is pleased to invite all our friends and partners to spend this significant day with us

Cryptocurrencies and digital rights: new regulation phase

July 30, 2024

Russian exporters and importers will be allowed to use cryptocurrencies in cross-border settlements under foreign trade agreements, but only within the experimental legal regime (ELR). The relevant draft law was adopted by the State Duma in the second and third reading.

Bank of Russia increases the key rate by 200 bp to 18.00% p.a.

July 26, 2024

The Bank of Russia’s Board of Directors decided to increase the key rate by 200 basis points to 18.00% per annum. Inflation has accelerated and is developing significantly above the Bank of Russia’s April forecast. Growth in domestic demand is still outstripping the capabilities to expand the supply of goods and services. For inflation to begin decreasing again, monetary policy needs to be tightened further. Returning inflation to the target requires considerably tighter monetary conditions than presumed earlier. The Bank of Russia will consider the necessity of further key rate increase at its upcoming meetings. The Bank of Russia’s forecast has been substantially revised, including the inflation forecast for 2024, which has been raised to 6.5–7.0%. Given the monetary policy stance, annual inflation will decline to 4.0–4.5% in 2025 and stay close to 4% further on.

Let's summarize the results of voting on the key rate

July 25, 2024

The market expects a rate increase to at least 17.0%, most to 18.0%. There are votes for 19.0% and 20.0% from the general community, but there are very few of them, while a significant part of local professionals does not exclude the immutability of the bet. There are no such people among the international community.

Stablecoins: regulators’ attitude to them around the globe

July 10, 2024

Russia, as well as other countries, is currently discussing the economic and legal nature of stablecoins and approaches to their regulation. The Bank of Russia analysed international trends in the field of stablecoins in its analytical report.

The government has relaxed the requirement for the mandatory sale of foreign exchange earnings by exporters

June 21, 2024

For the largest Russian exporters, the requirements for mandatory repatriation of foreign currency earnings have been relaxed. Previously, they were required to transfer at least 80% of the foreign currency received under foreign trade contracts to their accounts with authorized banks. Now this threshold has been lowered to 60%. The decision was made taking into account the stabilization of the national currency exchange rate and the achievement of a sufficient level of foreign exchange liquidity.

Information on procedure for setting official exchange rates of US dollar and euro

June 13, 2024

The Bank of Russia sets the official US dollar/ruble and euro/ruble exchange rates based on reporting data from credit institutions and the results of interbank conversion transactions in the over-the-counter FX market as of 15.30 Moscow time on the same business day.

Alternative approaches to calculating official exchange rates when there is no FX trading on the Moscow Exchange are provided for by Bank of Russia Ordinance No. 6290-U, dated 3 October 2022.

Alternative approaches to calculating official exchange rates when there is no FX trading on the Moscow Exchange are provided for by Bank of Russia Ordinance No. 6290-U, dated 3 October 2022.

Bank of Russia suspends trading in Hong Kong dollars and changes start time of trading session on Moscow Exchange

June 13, 2024

The Bank of Russia has decided to suspend trading in Hong Kong dollars from 13 June. On Thursday, trading sessions in the MOEX FX and precious metals markets and derivatives market with settlements in foreign currencies other than the US dollar, euro, and the Hong Kong dollar starts at 9.50 Moscow time.

Information on transactions in US dollars and euros due to sanctions against Moscow Exchange Group

June 12, 2024

Due to the introduction of restrictive measures by the Unites States against the Moscow Exchange Group, on-exchange trading and settlements of deliverable instruments in US dollars and euros are suspended. However, trading in all other exchange segments and instruments in rubles and other currencies will be conducted as normal. US dollars and euros will still be traded in the over-the-counter market.

To set the official exchange rate of the US dollar and euro against the ruble, the Bank of Russia will use bank reports and data received from digital over-the-counter trading platforms

To set the official exchange rate of the US dollar and euro against the ruble, the Bank of Russia will use bank reports and data received from digital over-the-counter trading platforms

Bank of Russia keeps the key rate at 16.00% p.a.

June 07, 2024

On 7 June 2024, the Bank of Russia Board of Directors decided to keep the key rate at 16.00% per annum. The current price growth rate has stopped decreasing and remains close to the levels of 2024 Q1. Growth in domestic demand is still outstripping the capabilities to expand the supply of goods and services. The Bank of Russia holds open the prospect of increasing the key rate at its upcoming meeting. Furthermore, returning inflation to the target will require a significantly longer period of maintaining tight monetary conditions in the economy than it was forecast in April. According to the Bank of Russia's forecast and given the monetary policy stance, annual inflation will return to the target in 2025 and stabilise close to 4% further on.

ACI RUSSIA HELD THE 20th ANNIVERSARY CONGRESS

May 27, 2024

On May 27, 2004, in London, ACI Russia was affiliated with the international association of financial market specialists ACI – The Financial Markets Association (Paris, France). And on May 27, 2024, the Association celebrated its 20th anniversary at the Ararat Park Hyatt Moscow hotel.

More than 160 guests – members and friends of ACI Russia – gathered at the Congress to wish us a happy birthday!

Also, this year became an elective one, and from 8:00 to 20:00 Moscow time, all current members of ACI Russia could vote for candidates for the positions of President, Vice-President and members of the Association's Council.

Read the details in the official press release

More than 160 guests – members and friends of ACI Russia – gathered at the Congress to wish us a happy birthday!

Also, this year became an elective one, and from 8:00 to 20:00 Moscow time, all current members of ACI Russia could vote for candidates for the positions of President, Vice-President and members of the Association's Council.

Read the details in the official press release

This year ACI Russia – The Financial Markets Association celebrates its 20th anniversary!

May 24, 2024

We invite you to take part in the 20th anniversary Congress of ACI Russia members!

It will be held on May 27 in Moscow from 18:00 till 23:00 Moscow time. Registration is mandatory for all participants! The program and all the news of the event are available on the Congress page in internet.

You are welcome!

It will be held on May 27 in Moscow from 18:00 till 23:00 Moscow time. Registration is mandatory for all participants! The program and all the news of the event are available on the Congress page in internet.

You are welcome!

Moscow Exchange trading schedule

May 20, 2024

On official public holiday on 12 June 2024 all Moscow Exchange markets will be closed.

MOEX trading calendar for 2024 is avaliable here

MOEX trading calendar for 2024 is avaliable here

The Bank of Russia keeps the key rate at 16.00% p.a.

April 26, 2024

On 26 April 2024, the Bank of Russia Board of Directors decided to keep the key rate at 16.00% per annum. Current inflationary pressures are gradually easing but remain high. Due to the remaining elevated domestic demand, which outstrips the capabilities to expand supply, inflation will return to the target somewhat more slowly than the Bank of Russia forecast in February.

Results of surveys on the key rate

April 25, 2024

In general, all categories of participants are confident that the bid will remain unchanged. Moreover, they themselves would have acted in the place of the Central Bank. However, our broad audience, which includes not only ACI members, disagreed on what the bid should be. Only 42% would vote to keep it at the current level.

This year ACI Russia – The Financial Markets Association celebrates its 20th anniversary!

April 23, 2024

On May 27, the Association will hold elections to the governing bodies of ACI Russia. And we are starting to accept applications from candidates!

If you want and are ready to join the Board of ACI Russia, become President or Vice-President of the Association, then send your details by emailacirussia@gmail.com or by phone +7 (926) 143-59-23 (WhatsApp/Telegram). You can also apply through our website

We remind you that ONLY current members of the Association can nominate their candidacies for the positions of members of the Council, President and Vice President of ACI Russia. The admission and exclusion of candidates to/from ACI Russia is carried out by the current Council of the Association. We also propose you to see with a list of recommendations and opportunities for candidates

According to the results of the voting, no more than 13 candidates will be elected to the ACI Russia Council, as well as the elected President and Vice President will automatically join the Council. Applications will be accepted exactly one week before the ACI Russia Congress – on May 20, 2024 at 20:00 Moscow time

We are glad to announce that we are opening registration for the 20th anniversary Congress of ACI Russia! We are waiting for you on May 27 at 18:00 at the Ararat Park Hyatt Hotel (Moscow, Neglinnaya str. 4, 2 floor, Sargsyan Hall).

The Congress will be held only in offline format (personal presence)! Recordings of official performances will be available later on our YouTube channel.

Please send all your suggestions on the business and not-so-business program of the Congress by e-mail acirussia@gmail.com or by phone +7 (926) 143-59-23 (WhatsApp/Telegram). We are glad to see your initiatives, memories, historical information on the activities of our Association in Russia, photo and video content, documents, speeches!

If you want and are ready to join the Board of ACI Russia, become President or Vice-President of the Association, then send your details by emailacirussia@gmail.com or by phone +7 (926) 143-59-23 (WhatsApp/Telegram). You can also apply through our website

We remind you that ONLY current members of the Association can nominate their candidacies for the positions of members of the Council, President and Vice President of ACI Russia. The admission and exclusion of candidates to/from ACI Russia is carried out by the current Council of the Association. We also propose you to see with a list of recommendations and opportunities for candidates

According to the results of the voting, no more than 13 candidates will be elected to the ACI Russia Council, as well as the elected President and Vice President will automatically join the Council. Applications will be accepted exactly one week before the ACI Russia Congress – on May 20, 2024 at 20:00 Moscow time

We are glad to announce that we are opening registration for the 20th anniversary Congress of ACI Russia! We are waiting for you on May 27 at 18:00 at the Ararat Park Hyatt Hotel (Moscow, Neglinnaya str. 4, 2 floor, Sargsyan Hall).

The Congress will be held only in offline format (personal presence)! Recordings of official performances will be available later on our YouTube channel.

Please send all your suggestions on the business and not-so-business program of the Congress by e-mail acirussia@gmail.com or by phone +7 (926) 143-59-23 (WhatsApp/Telegram). We are glad to see your initiatives, memories, historical information on the activities of our Association in Russia, photo and video content, documents, speeches!

MOEX trading schedule during the May holidays

April 22, 2024

We remind you how our markets will work during the May holidays this year.

• April 27th (working Saturday): auctions are held as usual (including in the evening session).

• April 28: No auctions are held.

• April 29-30 and May 10: auctions are held in all markets. On the foreign exchange and precious metals markets on these dates, as well as on April 27, transactions with TODAY settlements and swap transactions with an execution date on the date of conclusion are not concluded. Contracts with obligations in Russian rubles will not be implemented on over-the-counter transactions with the Central Committee on the ZPIF market.

• May 1, 4, 5 and 9: no auctions are held.

• May 2, 3, 6-8: auctions are held as usual.

• April 27th (working Saturday): auctions are held as usual (including in the evening session).

• April 28: No auctions are held.

• April 29-30 and May 10: auctions are held in all markets. On the foreign exchange and precious metals markets on these dates, as well as on April 27, transactions with TODAY settlements and swap transactions with an execution date on the date of conclusion are not concluded. Contracts with obligations in Russian rubles will not be implemented on over-the-counter transactions with the Central Committee on the ZPIF market.

• May 1, 4, 5 and 9: no auctions are held.

• May 2, 3, 6-8: auctions are held as usual.

The Bank of Russia keeps the key rate at 16.00% p.a.

March 22, 2024

On 22 March 2024, the Bank of Russia Board of Directors decided to keep the key rate at 16.00% per annum. Current inflationary pressures are gradually easing but remain high. Domestic demand is still outstripping the capabilities to expand the production of goods and services. Labour market tightness has increased again. For the moment, it is premature to judge the pace of future disinflationary trends. The Bank of Russia's monetary policy is set to solidify disinflation processes unfolding in the national economy.

Moscow Exchange trading schedule for 2024 public holidays

February 27, 2024

Moscow Exchange announces the trading schedule for its market for Russian public holidays in 2024.

On 3-5 January, 8 January, 29 and 30 April, 10 May and 30 December 2024, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On those days, all instruments will trade on the FX and Precious Metals Markets, except trades with "TODAY" settlement and swap transactions with their first parts settled on the same day.

On official public holidays on 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June and 4 November 2024, all Moscow Exchange markets will be closed.

Please note that Saturdays 27 April, 2 November, and 28 December 2024 are regular trading days.

On all other days in 2024, the markets will operate as usual.

On 3-5 January, 8 January, 29 and 30 April, 10 May and 30 December 2024, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On those days, all instruments will trade on the FX and Precious Metals Markets, except trades with "TODAY" settlement and swap transactions with their first parts settled on the same day.

On official public holidays on 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June and 4 November 2024, all Moscow Exchange markets will be closed.

Please note that Saturdays 27 April, 2 November, and 28 December 2024 are regular trading days.

On all other days in 2024, the markets will operate as usual.

Moscow Exchange trading schedule in February 2024

February 20, 2024

Moscow Exchange announces the trading schedule for its markets over the February 2024 public holiday period.

Friday, 23 February 2024 is a non-trading day on all MOEX markets due to a public holiday in Russia.

On 22 February 2024, all markets will operate as usual.

24 and 25 February are weekend days.

Friday, 23 February 2024 is a non-trading day on all MOEX markets due to a public holiday in Russia.

On 22 February 2024, all markets will operate as usual.

24 and 25 February are weekend days.

Bank of Russia keeps the key rate at 16.00% p.a.

February 16, 2024

On 16 February 2024, the Bank of Russia Board of Directors decided to keep the key rate at 16.00% per annum. Current inflationary pressures have eased compared with the autumn months but remain high. Domestic demand is still outstripping the capabilities to expand the production of goods and services. A judgement on the sustainable nature of emerging disinflationary trends would be premature. The Bank of Russia's monetary policy is set to solidify disinflation processes unfolding in the national economy.

Bank of Russia key rate survey 16.02.2024

February 15, 2024

Most participants from different market groups have the same opinion: The bid will remain unchanged. A third of the voting members of ACI Russia, being in the place of the Central Bank, would have already started lowering the rate, a significant part of the wider audience of the Association believes that the rate can be increased

ACI Russia & Friends New Year party 2024

December 18, 2023

On Monday evening, December 18, 2023, ACI Russia – The Financial Markets Association at Brasserie Lambic summed up the results of the outgoing year, bringing together members of the Association, guests, friends and their partners.

A warm and friendly atmosphere prevailed in Lambic, it smelled like a live Christmas tree, sparkling champagne in glasses, poems of their own composition sounded, the guests danced and sang along to the musicians of the restaurant EXPEDITION, who performed New Year's (and not only!) hits from different years.

ACI Russia thanks everyone who supported and was with us this year! And we look forward to meeting you in 2024:

• ACI Russia Congress – the 20th anniversary Congress of ACI Russia, the elections of the President and Council of the Association – May 27 (Monday), 2024. The location is being specified.

• Dealer's Fest 2024 – August 17 (Saturday) 2024, Loft Boat (Rio-1).

• The sixth Annual Conference on the development of electronic commerce in the Foreign exchange and Financial Markets - ACI Russia eFX Summit 2024 - October 31 (Thursday) 2024. The location is being specified.

• ACI Russia New Year's Eve Party – date and place are being specified.

• Online meetings on the most relevant and interesting topics – Pro Markets – ACI Russia – every Friday at 18:00 in Telegram and Clubhouse

A warm and friendly atmosphere prevailed in Lambic, it smelled like a live Christmas tree, sparkling champagne in glasses, poems of their own composition sounded, the guests danced and sang along to the musicians of the restaurant EXPEDITION, who performed New Year's (and not only!) hits from different years.

ACI Russia thanks everyone who supported and was with us this year! And we look forward to meeting you in 2024:

• ACI Russia Congress – the 20th anniversary Congress of ACI Russia, the elections of the President and Council of the Association – May 27 (Monday), 2024. The location is being specified.

• Dealer's Fest 2024 – August 17 (Saturday) 2024, Loft Boat (Rio-1).

• The sixth Annual Conference on the development of electronic commerce in the Foreign exchange and Financial Markets - ACI Russia eFX Summit 2024 - October 31 (Thursday) 2024. The location is being specified.

• ACI Russia New Year's Eve Party – date and place are being specified.

• Online meetings on the most relevant and interesting topics – Pro Markets – ACI Russia – every Friday at 18:00 in Telegram and Clubhouse

Bank of Russia increases key rate by 100 bp to 16.00% p.a.

December 15, 2023

On 15 December 2023, the Bank of Russia Board of Directors decided to increase the key rate by 100 basis points to 16.00% per annum. Current inflationary pressures remain high. Annual inflation for 2023 is expected to be close to the upper bound of the 7.0–7.5% forecast range. At the same time, the Bank of Russia expects GDP growth in 2023 to outperform its October forecast and exceed 3%. This suggests that the upward deviation of the Russian economy from a balanced growth path in 2023 H2 has proved more substantial than in the Bank of Russia's October estimates. Some segments of the credit market have shown signs of a slowdown, although overall lending growth rates remain high. Households' and businesses' inflation expectations have increased. The return of inflation to target in 2024 and its further stabilisation close to 4% assume that tight monetary conditions will be maintained in the economy for a long period.

ACI Russia & Friends New Year party 2024

December 13, 2023

Dear Members and friends of ACI Russia, we decided to spend the upcoming 2024th year in a new place on the previously scheduled date of December 18 (Monday).

There should be enough space for everyone, but the number of registrations is limited to 150! If the quota of 150 people ends, then the impact of your achievements in 2023 on the activities of our Association will begin. Carefully read the terms and conditions on the registration page!

Happy New Year to you!

There should be enough space for everyone, but the number of registrations is limited to 150! If the quota of 150 people ends, then the impact of your achievements in 2023 on the activities of our Association will begin. Carefully read the terms and conditions on the registration page!

Happy New Year to you!

On oil and gas revenues and transactions for the purchase/sale of foreign currency and gold in the domestic foreign exchange market

December 5, 2023

The expected volume of additional oil and gas revenues of the federal budget is projected in December 2023 in the amount of 362.0 billion rubles. The deviation of actually received oil and gas revenues from the expected monthly volume of oil and gas revenues by the end of November 2023 amounted to minus 117.2 billion rubles. Thus, the total amount of funds allocated for the purchase of foreign currency and gold is 244.8 billion rubles. The operations will be carried out in the period from December 7, 2023 to January 12, 2024, respectively, the daily volume of purchases of foreign currency and gold will amount to the equivalent of 11.7 billion rubles.

MOEX expands the list of FX market instruments

November 28, 2023

MOEX is launching new instruments on the FX market for the Chinese yuan – Russian ruble pair, which will allow participants to conclude transactions at the weighted average yuan exchange rate and currency fixing.

The CNYRUB_WAP0 and CNYRUB_WAPV tools increase the convenience of conversion operations for market participants. Using the CNYRUB_WAP0 tool, you can enter into transactions directly at the weighted average yuan exchange rate by TOM calculations, the CNYRUB_WAPV tool includes a discount/premium to the weighted average yuan exchange rate by TOM calculations.

The CNYRUB_WAP0 and CNYRUB_WAPV tools increase the convenience of conversion operations for market participants. Using the CNYRUB_WAP0 tool, you can enter into transactions directly at the weighted average yuan exchange rate by TOM calculations, the CNYRUB_WAPV tool includes a discount/premium to the weighted average yuan exchange rate by TOM calculations.

ACI Russia eFX Summit 2023

November 13, 2023

On November 13, 2023, the 5th annual conference on the development of electronic commerce in the currency and financial markets - ACI Russia eFX Summit 2023 - was held at the Solux Hotel in Moscow. To expand the geography of the event, the summit was held in a hybrid format, bringing together 210 participants offline and more than 70 in online broadcast.

The mission of the Summit is to unite all participants of the financial industry of Russia and the CIS countries on one platform for an open discussion, discussion of current factors and trends affecting the development of instruments, infrastructure and technologies for trading in currency, derivatives and digital financial asset markets, establishing relationships and entering into partnerships.

The mission of the Summit is to unite all participants of the financial industry of Russia and the CIS countries on one platform for an open discussion, discussion of current factors and trends affecting the development of instruments, infrastructure and technologies for trading in currency, derivatives and digital financial asset markets, establishing relationships and entering into partnerships.

Monetary Policy Guidelines for 2024–2026

November 02, 2023

In the Monetary Policy Guidelines, the Bank of Russia each year describes the goals of monetary policy and approaches to its implementation and provides its view of the current situation in the economy and forecasts of its development in the medium term.

Bank of Russia increases key rate by 200 bp to 15.00% p.a.

October 27, 2023

The Bank of Russia Board of Directors decided to increase the key rate by 200 basis points to 15.00% per annum. Current inflationary pressures have significantly increased to a level above the Bank of Russia's expectations. Steadily rising domestic demand is increasingly exceeding the capabilities to expand the production of goods and the provision of services. Inflation expectations remain elevated. Lending growth paces are invariably high. The updated medium-term parameters of fiscal policy assume a slower than expected decline in fiscal stimulus in the years ahead. Therefore, it is required to additionally tighten monetary policy to limit the upward deviation of inflation from target and return it to 4% in 2024. The return of inflation to target and its further stabilisation close to 4% also means that tight monetary conditions will be maintained in the economy for a long period.

Before of the Bank of Russia's decision on the rate, ACI Russia conducted a survey of rank participants according to their expectations

October 27, 2023

The majority believes that the rate will be raised and that it really needs to be raised. We expect 14.0% despite the fact that the RUB exchange rate is relatively stable and is gradually strengthening, and inflation is 6.0%

In order to stabilize the exchange rate, the mandatory sale of foreign exchange earnings of exporters is established

October 11, 2023

The President of Russia signed a decree "On the implementation of the mandatory sale of proceeds in foreign currency received by individual Russian exporters under foreign trade agreements (contracts)."

Registration for the ACI Russia eFX Summit 2023 begins!

October 03, 2023

We are opening registration for the key annual event in Russia on the development of electronic commerce in the foreign exchange market - ACI Russia eFX Summit 2023. The event will be held on November 13 (Monday) at the new Soluxe Moscow Hotel at the address: 16 Wilhelm Peak Str., Moscow

Two years of global changes, transformation of world markets, shocks and new challenges - we are sure that we have something to discuss not only with the Russian, but also the global financial community

The summit will bring together corporate cashflow managers and system traders, hedge funds, international and regional banks (global trade managers, heads of currency departments, execution managers, portfolio managers, IT directors and CEOs) on one platform from all over the world for open discussion, networking and entering into partnerships.

Two years of global changes, transformation of world markets, shocks and new challenges - we are sure that we have something to discuss not only with the Russian, but also the global financial community

The summit will bring together corporate cashflow managers and system traders, hedge funds, international and regional banks (global trade managers, heads of currency departments, execution managers, portfolio managers, IT directors and CEOs) on one platform from all over the world for open discussion, networking and entering into partnerships.

Bank of Russia extends restrictions on money transfers abroad for another six months

September 29, 2023

The restrictions will be in effect from 1 October 2023 through 31 March 2024.

Russian citizens and non-resident individuals from friendly countries will still be allowed to transfer no more than 1 million US dollars (or an equivalent amount in other foreign currencies) to any accounts in foreign banks within a month.

The limits on transfers via money transfer systems also remain in place: total transfers may not exceed 10,000 US dollars (or an equivalent amount in other foreign currencies) per month. The amounts of transfers are calculated at the official exchange rate of foreign currencies against the ruble as of the date the bank receives the transaction order.

Non-resident individuals working in Russia, whether they are from friendly or unfriendly countries, are allowed to transfer funds abroad in the amount of their salary.

The ban on money transfers remains in place for non-resident individuals from unfriendly countries not working in Russia and legal entities from such states. This restriction does not apply to foreign companies controlled by Russian legal entities or individuals.

Banks from unfriendly states may transfer funds in rubles using correspondent accounts opened with Russian credit institutions, provided that the payer and the payee have accounts with foreign banks.

Russian citizens and non-resident individuals from friendly countries will still be allowed to transfer no more than 1 million US dollars (or an equivalent amount in other foreign currencies) to any accounts in foreign banks within a month.

The limits on transfers via money transfer systems also remain in place: total transfers may not exceed 10,000 US dollars (or an equivalent amount in other foreign currencies) per month. The amounts of transfers are calculated at the official exchange rate of foreign currencies against the ruble as of the date the bank receives the transaction order.

Non-resident individuals working in Russia, whether they are from friendly or unfriendly countries, are allowed to transfer funds abroad in the amount of their salary.

The ban on money transfers remains in place for non-resident individuals from unfriendly countries not working in Russia and legal entities from such states. This restriction does not apply to foreign companies controlled by Russian legal entities or individuals.

Banks from unfriendly states may transfer funds in rubles using correspondent accounts opened with Russian credit institutions, provided that the payer and the payee have accounts with foreign banks.

The 9th edition of ACI FMA Insights Newsletter it's now available!

September 21, 2023

We are pleased to present to you the 9th edition of the ACI FMA Insights Newsletter, an edition dedicated to the 61st ACI World Congress, which will take place in Singapore next week.

In this new edition, you can also find some more information about ACI FMA Education, on the importance of continuous training, certification, good practices, and the numerous possibilities that the ELAC platform offers to financial market participants, as well as the joint welcome message from Stéphane Malrait, ACI FMA Chairman and Kim Winding Larsen, ACI FMA President.

The objective of the Newsletter is to bring news and updates from ACI FMA activity to all our global ACI members.

ACI FMA are longstanding proponents and influencers of ethical conduct and good market practices to all financial market professionals.

Please visit our page at https://acifma.com/newsletters to access this Newsletter and the previous numbers.

In this new edition, you can also find some more information about ACI FMA Education, on the importance of continuous training, certification, good practices, and the numerous possibilities that the ELAC platform offers to financial market participants, as well as the joint welcome message from Stéphane Malrait, ACI FMA Chairman and Kim Winding Larsen, ACI FMA President.

The objective of the Newsletter is to bring news and updates from ACI FMA activity to all our global ACI members.

ACI FMA are longstanding proponents and influencers of ethical conduct and good market practices to all financial market professionals.

Please visit our page at https://acifma.com/newsletters to access this Newsletter and the previous numbers.

The government has approved a list of countries whose banks will be able to participate in currency trading in Russia

September 20, 2023

The Government has approved a list of more than 30 countries whose banks and brokers are allowed to trade on the Russian foreign exchange and derivatives markets. The list includes "friendly and neutral countries", including China, India, Turkey, Serbia, the UAE, Iran, South Africa, Kyrgyzstan and Belarus. The Cabinet of Ministers stated that this should help meet the demand of the Russian economy for settlements in the national currency

Moscow Exchange trading schedule for 2024 public holidays

September 20, 2023

Moscow Exchange announces the trading schedule for its market for Russian public holidays in 2024.

On 3-5 January, 8 January, 29 and 30 April, 10 May and 30 December 2024, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On those days, all instruments will trade on the FX and Precious Metals Markets, except trades with "TODAY" settlement and swap transactions with their first parts settled on the same day.

On official public holidays on 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June and 4 November 2024, all Moscow Exchange markets will be closed.

Please note that Saturdays 27 April, 2 November, and 28 December 2024 are regular trading days.

On all other days in 2024, the markets will operate as usual.

On 3-5 January, 8 January, 29 and 30 April, 10 May and 30 December 2024, the FX, Precious Metals, Equity and Bond, Deposit, Credit, Derivatives and OTC Standardised Derivatives Markets will be open.

On those days, all instruments will trade on the FX and Precious Metals Markets, except trades with "TODAY" settlement and swap transactions with their first parts settled on the same day.

On official public holidays on 1-2 January, 7 January, 23 February, 8 March, 1 May, 9 May, 12 June and 4 November 2024, all Moscow Exchange markets will be closed.

Please note that Saturdays 27 April, 2 November, and 28 December 2024 are regular trading days.

On all other days in 2024, the markets will operate as usual.

Bank of Russia increases key rate by 100 bp to 13.00% p.a.

September 15, 2023

The Bank of Russia Board of Directors decided to increase the key rate by 100 basis points to 13.00% per annum. Inflationary pressure in the Russian economy remains high. Significant proinflationary risks have crystallised, namely the domestic demand growth outpacing the output expansion capacity and the depreciation of the ruble in the summer months. Therefore, it is required to additionally tighten monetary conditions to limit the upward deviation of inflation from the target and return it to 4% in 2024. The return of inflation to the target and its further stabilisation close to 4% also implies that tight monetary conditions will be maintained in the economy for a long period.

Voting results on the size of the key rate in ACI Russia social networks

September 14, 2023

This time the range of opinions is very wide for a scheduled meeting. Various signals have been received since the last unscheduled one. The international community is more inclined to the fact that the rate will not be changed, the Russian one that there will be an increase.

DEALER'S FESTIVAL 2023

August 18, 2023

On August 17, 2023, the default of 1998 turned 25 years old! On this occasion, ACI Russia gathered more than 400 guests, friends and partners at the traditional meeting of the interbank and financial community – Dealer's Fest.

The program of the evening turned out to be very interesting and rich! Three musical groups of different styles and directions, a presentation of sculpture and own smell of the event, contests and prizes from leading dealers, karaoke and disco with hits of 1998 and 2008. Thank you for being with us on this significant date!

The program of the evening turned out to be very interesting and rich! Three musical groups of different styles and directions, a presentation of sculpture and own smell of the event, contests and prizes from leading dealers, karaoke and disco with hits of 1998 and 2008. Thank you for being with us on this significant date!

Bank of Russia increases key rate by 350 b.p. to 12.00% p.a.

August 15, 2023

The Bank of Russia Board of Directors decided to increase the key rate by 350 basis points to 12.00% per annum from 15 August 2023. The decision is aimed at limiting price stability risks.

The Bank of Russia Board of Directors will hold a meeting to discuss the level of the key rate

August 14, 2023

Both ACI members and a wider circle of market participants believe that at an extraordinary meeting of the Board of Directors of the Bank of Russia, the rate will be raised to around 10.0% per annum, while the professional circle is more restrained in its forecasts

ACI Russia has taken the initiative to hold the 25th anniversary of the Dealer's Day together with MMVA

July 28, 2023

A corresponding letter was sent to the President and the Council of the Moscow International Monetary Association to make this year's dealer holiday outstanding and unforgettable. "We believe that now, more than ever, all market participants need unity and holding a common dealer holiday would benefit the members of both our organizations," the letter says.

The full text can be found at the link below

And we are waiting for everyone on the Loft Boat on August 17 at 19:00. Details and registration are here

The full text can be found at the link below

And we are waiting for everyone on the Loft Boat on August 17 at 19:00. Details and registration are here

Bank of Russia increases key rate by 100 b.p. to 8.50% p.a.

July 21, 2023

On 21 July 2023, the Bank of Russia Board of Directors decided to increase the key rate by 100 basis points to 8.50% per annum. Current price growth rates, including a variety of underlying indicators, have exceeded 4% in annualised terms and are still on the rise. The increase in the domestic demand surpasses the capacity to expand production, including due to the limited availability of labour resources. This reinforces persistent inflationary pressure in the economy. Inflation expectations have risen. Domestic demand trends and the depreciation of the ruble since the beginning of 2023 significantly amplify proinflationary risks. The Bank of Russia's monetary policy will curtail inflation's upward deviation from the target and is aimed at bringing inflation back to 4% in 2024.

Bank of Russia key rate survey

July 20, 2023

Opinions have quite strongly split and divided, concentrating around a rate increase of 50 bps. Attention is drawn to the fact that the responses of the Russian professional part of the community are more inclined to the rate of 8.5%, while the international one to 8.0% at the meeting on Friday

DEALER'S FEST 2023. 25 YEARS OF DEFAULT!

July 18, 2023

On August 17, the financial community recalls the events of 1998, when Russia defaulted on the main types of government securities. On this date, a new era of the Russian financial market began. Those who "survived" received a harsh lesson in proper risk management, the importance of trust and the need for proper development of public finances. And in 2023 we are celebrating our 25th anniversary!

Venue: Loft Boat (Moscow)

Route: from the berth of the Northern River Station along the Moscow Canal and back

Time: Thursday, August 17th. At 19:30 the ship sails, do not be late!

At 24:00 we will return to the Northern River Station

There will be no stops along the trip

And don't forget to capture the good market mood!

Venue: Loft Boat (Moscow)

Route: from the berth of the Northern River Station along the Moscow Canal and back

Time: Thursday, August 17th. At 19:30 the ship sails, do not be late!

At 24:00 we will return to the Northern River Station

There will be no stops along the trip

And don't forget to capture the good market mood!

Launch of the Global Cryptoasset Standards

July 11, 2023

We are pleased to inform you that, today, the Global Cryptoasset Standards have been launched by GBBC Digital Finance (GDF).

The Standards are a code of conduct for financial institutions engaging in intermediation activities such as brokerage, custody, and settlement of cryptoassets like bitcoin and Ethereum.

This document was inspired by global best practice industry standards and codes, such as the FX Global Code, and it offers robust industry best practices to ensure regulated firms meet the highest standards of conduct when handling cryptoassets.

ACI FMA, as a participating member of the Global Financial Institutions for Cryptoassets Working Group that took the leading role in the concept, development and implementation of these Standards, is extremely proud to have collaborated on these important guidelines for all Market Participants in the Cryptoasset Market.

The Standards are a code of conduct for financial institutions engaging in intermediation activities such as brokerage, custody, and settlement of cryptoassets like bitcoin and Ethereum.

This document was inspired by global best practice industry standards and codes, such as the FX Global Code, and it offers robust industry best practices to ensure regulated firms meet the highest standards of conduct when handling cryptoassets.

ACI FMA, as a participating member of the Global Financial Institutions for Cryptoassets Working Group that took the leading role in the concept, development and implementation of these Standards, is extremely proud to have collaborated on these important guidelines for all Market Participants in the Cryptoasset Market.

How can a retail investor distinguish high-quality financial analytics from low-quality

June 21, 2023

The Association of Financial Analysts (AFA) and the National Financial Association (NFA) have jointly created a checklist for retail investors, which will help distinguish high-quality financial analytics from low-quality ones.

ACI Russia has prepared recommendations for the Code of trading participants on MOEX

June 09, 2023

ACI Russia, together with the Moscow Exchange working group on the Code of Conduct, has prepared recommendations to market participants to minimize currency exchange rate fluctuations.

The Code has a recommendation character. At the same time, taking into account the importance of the purpose of the Code, MOEX encourages Organizations to join the Code and strive to carry out their activities in the financial market in accordance with the principles of the Code. To join the Code, it is necessary to send a signed Declaration of Accession to the Code to the Department for Internal Control and Compliance of PJSC Moscow Exchange.

The Code has a recommendation character. At the same time, taking into account the importance of the purpose of the Code, MOEX encourages Organizations to join the Code and strive to carry out their activities in the financial market in accordance with the principles of the Code. To join the Code, it is necessary to send a signed Declaration of Accession to the Code to the Department for Internal Control and Compliance of PJSC Moscow Exchange.

Bank of Russia keeps the key rate at 7.50% p.a.

June 9, 2023

The Bank of Russia Board of Directors decided to keep the key rate 7.50% per annum. Current price growth rates, including the stable indicators of inflation, continue to increase. Inflation expectations of households and businesses' price expectations remain high. Economic activity is rising faster than the Bank of Russia's April forecast assumed, which in large measure reflects a strong rebound in domestic demand. Accelerating fiscal spending, deteriorating terms of foreign trade and the situation in the labour market remain pro-inflationary risk drivers. The overall balance of inflation risks has tilted even more to the upside.

ACI Russia's сommunity voting on the key rate

June 08, 2023

This time we conducted a separate survey on the rate in the closed group ACI Russia, which consists only of members of the community, and in a broader public group.

In general, the prevailing professional opinion on both sides of the borders of the Russian Federation is that the RUB rate will be maintained at the current level.

It is noteworthy that the range of solutions offered by the public group is much wider and has less concentration on the current rate.

In general, the prevailing professional opinion on both sides of the borders of the Russian Federation is that the RUB rate will be maintained at the current level.

It is noteworthy that the range of solutions offered by the public group is much wider and has less concentration on the current rate.

Moscow Exchange trading schedule in June 2023

June 1, 2023

Moscow Exchange announces the trading schedule for its markets in June 2023.

The Moscow Exchange Equity & Bond, Money, Derivatives, FX and Precious Metals Markets will be closed for trading and settlement on the holiday weekend of 12 June 2023.

The Moscow Exchange Equity & Bond, Money, Derivatives, FX and Precious Metals Markets will be closed for trading and settlement on the holiday weekend of 12 June 2023.

ACI Russia Congress 2023

May 18, 2023

More than 120 members, friends and guests of the Association gathered at the ACI Russia evening event at the ART COURT Moscow Center Hotel.

During the Congress, ACI Russia President Evgeny Egorov and ACI Russia Vice President Dmitry Piskulov made a report on the work of the Association's Board and management for the year, and also presented ACI Russia's plans for future periods. According to the results of the voting of the members of the Association present, the work of the Council was recognized as satisfactory and unanimously supported by the delegates of the Congress.

The next presentation was an interview with Evgeny Egorov, President of ACI Russia, with Valery Lyakh, Director of the Bank of Russia's Department for Countering Misconduct. Evgeny tried to accumulate all the issues of concern to market participants, and the interview turned out to be lively and very relevant. They also touched upon the use of AI in financial markets and, in particular, in the work of the Bank of Russia itself.

Roman Loktionov, Director of OTC Derivatives at the MOEX, spoke in detail about the instruments of the SPFI market for Chinese yuan. The participants of the Congress also discussed the use of artificial intelligence in the financial market, future trends and forecasts, the most incredible developments until 2050. Panel moderator Pavel Pikulev (CEO EMCR.io ) invited leading analysts: Egor Susin (Gazprombank), Viktor Tunev (@Truevalue), Mikhail Vasiliev (Sovcombank), Valery Weisberg (IK Region), Anton Tabakh (Expert RA) to participate in the foresight game and speculate on the future of the economy, and everything humanity as a whole!

At the end of the official part, all the guests were waiting for a cocktail and irreplaceable communication on the sidelines, as well as gifts from the partner of ACI Russia Congress 2023 – the supplier of natural coffee LES COFFE. Sovcombank also pleased the guests of the Congress with original magazines with comics about financial markets.

During the Congress, ACI Russia President Evgeny Egorov and ACI Russia Vice President Dmitry Piskulov made a report on the work of the Association's Board and management for the year, and also presented ACI Russia's plans for future periods. According to the results of the voting of the members of the Association present, the work of the Council was recognized as satisfactory and unanimously supported by the delegates of the Congress.

The next presentation was an interview with Evgeny Egorov, President of ACI Russia, with Valery Lyakh, Director of the Bank of Russia's Department for Countering Misconduct. Evgeny tried to accumulate all the issues of concern to market participants, and the interview turned out to be lively and very relevant. They also touched upon the use of AI in financial markets and, in particular, in the work of the Bank of Russia itself.

Roman Loktionov, Director of OTC Derivatives at the MOEX, spoke in detail about the instruments of the SPFI market for Chinese yuan. The participants of the Congress also discussed the use of artificial intelligence in the financial market, future trends and forecasts, the most incredible developments until 2050. Panel moderator Pavel Pikulev (CEO EMCR.io ) invited leading analysts: Egor Susin (Gazprombank), Viktor Tunev (@Truevalue), Mikhail Vasiliev (Sovcombank), Valery Weisberg (IK Region), Anton Tabakh (Expert RA) to participate in the foresight game and speculate on the future of the economy, and everything humanity as a whole!

At the end of the official part, all the guests were waiting for a cocktail and irreplaceable communication on the sidelines, as well as gifts from the partner of ACI Russia Congress 2023 – the supplier of natural coffee LES COFFE. Sovcombank also pleased the guests of the Congress with original magazines with comics about financial markets.

ACI FMA Insights Nº 8

May 12, 2023

The 8th edition of ACI FMA Insights Newsletter has been launched and it's now available!

This new edition is dedicated to the ACI FMA Spring Meetings and the 31stACI FMA Croatia General Assembly and Financial Markets Conference 2023, which will take place in Zagreb from 16th to 19th May. Additional details and much more can be found in the column that Mario Kolinski, ACI Croatia President shared with us. Please also visit the Congress website for more details: https://acifma.hr/zg2023-en/

In this edition, you can also find the contribution of John K. Estrada, ACI FMA Chair of FX Committee, the detailed vision of Rui Correia, ACI FMA Executive Director and Chair of the Board of Education, on the importance of continuous training, certification, good practices and the numerous possibilities that the ELAC platform offers to financial market participants, as well as the joint welcome message from Stéphane Malrait, ACI FMA Chairman and Kim Winding Larsen, ACI FMA President.

The objective of the Newsletter is to bring news and updates from ACI FMA activity to all our global ACI members.

ACI FMA are longstanding proponents and influencers of ethical conduct and good market practices to all financial market professionals.

This new edition is dedicated to the ACI FMA Spring Meetings and the 31stACI FMA Croatia General Assembly and Financial Markets Conference 2023, which will take place in Zagreb from 16th to 19th May. Additional details and much more can be found in the column that Mario Kolinski, ACI Croatia President shared with us. Please also visit the Congress website for more details: https://acifma.hr/zg2023-en/

In this edition, you can also find the contribution of John K. Estrada, ACI FMA Chair of FX Committee, the detailed vision of Rui Correia, ACI FMA Executive Director and Chair of the Board of Education, on the importance of continuous training, certification, good practices and the numerous possibilities that the ELAC platform offers to financial market participants, as well as the joint welcome message from Stéphane Malrait, ACI FMA Chairman and Kim Winding Larsen, ACI FMA President.

The objective of the Newsletter is to bring news and updates from ACI FMA activity to all our global ACI members.

ACI FMA are longstanding proponents and influencers of ethical conduct and good market practices to all financial market professionals.

ACI Russia Congress 2023 - start of application acceptance!

April 28, 2023

We are pleased to announce that we are starting registration for the 19th Congress of Members and Friends of the Association - ACI Russia Congress 2023!

May 18, 2023 (Thursday) at the ART COURT Moscow Center Hotel we are waiting for you at 17:00.

ACI Russia has been holding general meetings of the organization annually since its foundation in 2004. This event is not just a formal event, but also a traditional meeting place for the Russian dealer community. The Association continues to focus on representing and protecting the interests of financial market specialists, promoting mutual understanding and education based on professional ethics, strengthening international relations, developing innovation and market initiatives, conducting a dialogue with the regulator and providing its professional expertise.

This year's program includes a report by the President of the Association Evgeny Egorov, a speech by a representative of the regulator, a discussion by leading analysts and experts and, of course, irreplaceable networking with colleagues and informal communication.

May 18, 2023 (Thursday) at the ART COURT Moscow Center Hotel we are waiting for you at 17:00.

ACI Russia has been holding general meetings of the organization annually since its foundation in 2004. This event is not just a formal event, but also a traditional meeting place for the Russian dealer community. The Association continues to focus on representing and protecting the interests of financial market specialists, promoting mutual understanding and education based on professional ethics, strengthening international relations, developing innovation and market initiatives, conducting a dialogue with the regulator and providing its professional expertise.

This year's program includes a report by the President of the Association Evgeny Egorov, a speech by a representative of the regulator, a discussion by leading analysts and experts and, of course, irreplaceable networking with colleagues and informal communication.

Bank of Russia keeps key rate at 7.50% p.a.

April 28, 2023

The Bank of Russia Board of Directors decided to keep the key rate at 7.50% per annum. Current rates of price growth have increased since late 2022 but remain moderate, including in the stable components of inflation. Inflation expectations of households are down. They nevertheless remain elevated, as do businesses' price expectations. Economic activity is rising faster than the February forecast of the Bank of Russia assumed. This reflects both an expansion in domestic demand and the ongoing processes of transformation of the Russian economy. Accelerating fiscal spending, deteriorating terms of foreign trade and the situation in the labour market continue to pose pro-inflation risks. The overall balance of inflation risks has remained essentially the same since the previous Board meeting.

Moscow Exchange trading schedule over May holidays

March 24, 2023

Moscow Exchange announces the trading schedule for its markets for public holidays in Russia in May 2023.

On 8 May, a public holiday, the markets will operate as follows:

On 28 April, 2-5 and 10-12 May 2023, which are official working days, the Equity and Bond, Money, FX, Precious Metals, Derivatives and Standartised OTC Derivatives Markets will trade as usual.

On 29–30 April, 1 May, 6–7 May and 9 May 2023, all MOEX markets are closed.

On 8 May, a public holiday, the markets will operate as follows:

- the Equity and Bond, Money, Deposit, Credit and Derivatives Markets will trade as usual;

- the FX and Precious Metals Markets will trade all instruments, except for spot transactions settled on the trade date (TODAY settlement) and overnight swaps;

- OTC transactions with the central counterparty (CCP) in the Standardised OTC Derivatives Market (SPFI) will be settled for all instruments, except for SPFI contracts involving obligations denominated in Russian roubles.

On 28 April, 2-5 and 10-12 May 2023, which are official working days, the Equity and Bond, Money, FX, Precious Metals, Derivatives and Standartised OTC Derivatives Markets will trade as usual.

On 29–30 April, 1 May, 6–7 May and 9 May 2023, all MOEX markets are closed.

Bank of Russia keeps key rate at 7.50% p.a.

March 17, 2023

The Bank of Russia Board of Directors decided to keep the key rate at 7.50% per annum. Current rates of price growth remain moderate, including in the stable components of inflation. Inflation expectations of households are down significantly but remain elevated, as do businesses' price expectations. High-frequency data suggest that a recovery in business and consumer activity is ongoing. Accelerating fiscal spending, deteriorating terms of foreign trade and the situation in the labour market continue to pose pro-inflation risks. The overall balance of inflation risks has remained essentially the same since the previous Board meeting.

Experts are unanimous on the eve of the decision on the key rate of the Bank of Russia

March 16, 2023

According to the survey results, an ideal picture turns out: according to all analysts, the Bank of Russia will definitely leave the rate unchanged. At the same time, if some participants were in the place of the Board of the Bank of Russia, then one person would raise it by 50 bps, and one person would lower it by the same 50 bps. We are waiting for a decision tomorrow

Bank of Russia establishes International Settlements Department

February 15, 2023

A new structural unit — the International Settlements Department — has been created at the Bank of Russia on 15 February 2023.

The Department will deal with issues that have become especially relevant in view of Russia sanctions. These issues include the development of correspondent relations between Russian banks and their counterparties from friendly countries, transition to settlements in national currencies, as well as the expansion of opportunities for cross-border transactions.

The new department is headed by Mikhail Kovrigin, the former director of the Financial Market Strategy Department.

In addition, a decision was made to establish from 15 February 2023 the Department for Cooperation with International Organisations on the basis of the International Cooperation Department, which, in turn, will be abolished before 1 September 2023.

The Department will deal with issues that have become especially relevant in view of Russia sanctions. These issues include the development of correspondent relations between Russian banks and their counterparties from friendly countries, transition to settlements in national currencies, as well as the expansion of opportunities for cross-border transactions.

The new department is headed by Mikhail Kovrigin, the former director of the Financial Market Strategy Department.

In addition, a decision was made to establish from 15 February 2023 the Department for Cooperation with International Organisations on the basis of the International Cooperation Department, which, in turn, will be abolished before 1 September 2023.

Bank of Russia keeps key rate at 7.50% p.a.

February 10, 2023

The Bank of Russia Board of Directors decided to keep the key rate at 7.50% per annum. Current price growth rates are increasing, remaining moderate in terms of sustainable components. Inflation expectations of households and businesses edged down but remain elevated. Economic activity trends evolve better than the Bank of Russia's October forecast. Although households' consumer behaviour is still cautious, there appear signs of recovery in consumer activity. Accelerating fiscal spending, deteriorating terms of foreign trade and situation in the labour market intensify pro-inflation risks.

Moscow Exchange trading schedule in February 2023

January 31, 2023

Moscow Exchange announces the trading schedule for its markets over the February 2023 public holiday period.

23 February 2023 is a non-trading day on all MOEX markets.

On Friday, 24 February 2023, the markets will operate as follows:

23 February 2023 is a non-trading day on all MOEX markets.

On Friday, 24 February 2023, the markets will operate as follows:

- The Equity and Bond, Deposit and Credit and Derivatives Markets will trade as usual;

- The FX and Precious Metals Markets will trade all instruments, except for spot transactions settled on the trade date (TODAY settlement) and overnight swaps; and

- OTC transactions with the central counterparty (CCP) in the Standardised OTC Derivatives Market (SPFI) will be settled for all instruments, except for SPFI contracts involving obligations denominated in Russian roubles.

ACI FMA Spring Meetings: Zagreb, 16-18 May

January 30, 2023

As announced, ACI FMA is pleased to confirm that the 2023 Spring Meetings will be held in Zagreb, from 16th to 18th May.

For the first time, ACI Croatia will be welcoming the ACI FMA community and hosting the ACI Spring Meetings, which will be followed by the ACI FMA Croatia Annual Assembly and Financial Markets Conference, on the 19th of May.

Save the Date and join us in Croatia! We are currently working on the Agenda and will be updating this topic regularly. Please stay tuned.

Discover the preliminary programme below

For the first time, ACI Croatia will be welcoming the ACI FMA community and hosting the ACI Spring Meetings, which will be followed by the ACI FMA Croatia Annual Assembly and Financial Markets Conference, on the 19th of May.

Save the Date and join us in Croatia! We are currently working on the Agenda and will be updating this topic regularly. Please stay tuned.

Discover the preliminary programme below

The implementation of the projects INTERBANK and DIPLOMACY has begun

January 27, 2023

In the context of the termination of correspondent and counterparty relations of Russian commercial banks, including those that have not been sanctioned, with banks of unfriendly countries, the implementation of the projects "Interbank" and "Diplomacy" has begun to facilitate the establishment of new correspondent, counterparty, social and cultural relations of the community of specialists of the Russian financial market with the relevant communities of neutral countries.

The main objectives of the projects are to develop contacts with national organizations of the International Association of Financial Market Specialists ACI Financial Markets Association (ACI FMA) and the diplomatic services of the respective countries, the organization of negotiations on the establishment of direct interbank correspondent relations in national currencies, primarily with banks in China and the UAE.

The main objectives of the projects are to develop contacts with national organizations of the International Association of Financial Market Specialists ACI Financial Markets Association (ACI FMA) and the diplomatic services of the respective countries, the organization of negotiations on the establishment of direct interbank correspondent relations in national currencies, primarily with banks in China and the UAE.

Bank of Russia comments on fiscal rule-based operations in domestic FX market

January 11, 2023

According to the procedure published by the Ministry of Finance of the Russian Federation, on 13 January 2023, the Bank of Russia will resume FX buy (sell) operations in the domestic FX market as part of the Ministry's fiscal rule mechanism.

These operations will be performed in the Moscow Exchange FX Market for CNYRUB_TOM instrument.

In order to minimise the impact of the above operations on the exchange rate dynamics, the Bank of Russia will buy (sell) foreign currency in the market evenly throughout every trading day of the month.